How Are For-Profit and Nonprofit Businesses Different?

Once an organization is given tax-exempt status, it is considered a not-for-profit or charity type of business. Even though these are tax-exempt organizations, they still file annual tax returns like for-profit companies. publication 946 2022 how to depreciate property internal revenue service Tax-exempt organizations must adhere to public disclosure requirements, and must make meeting minutes…

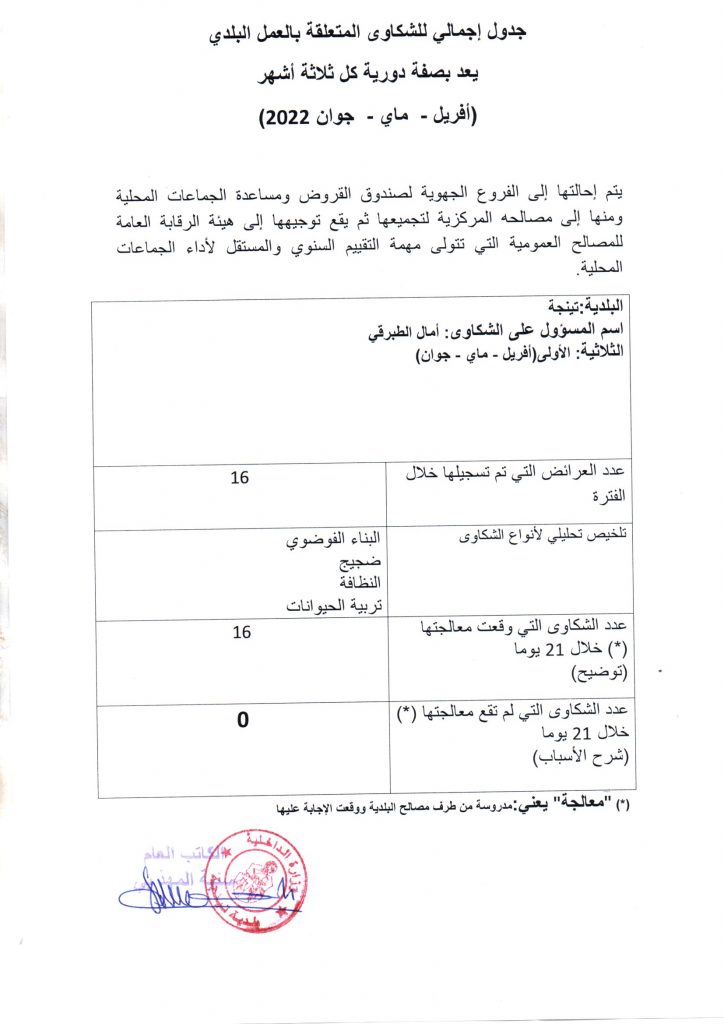

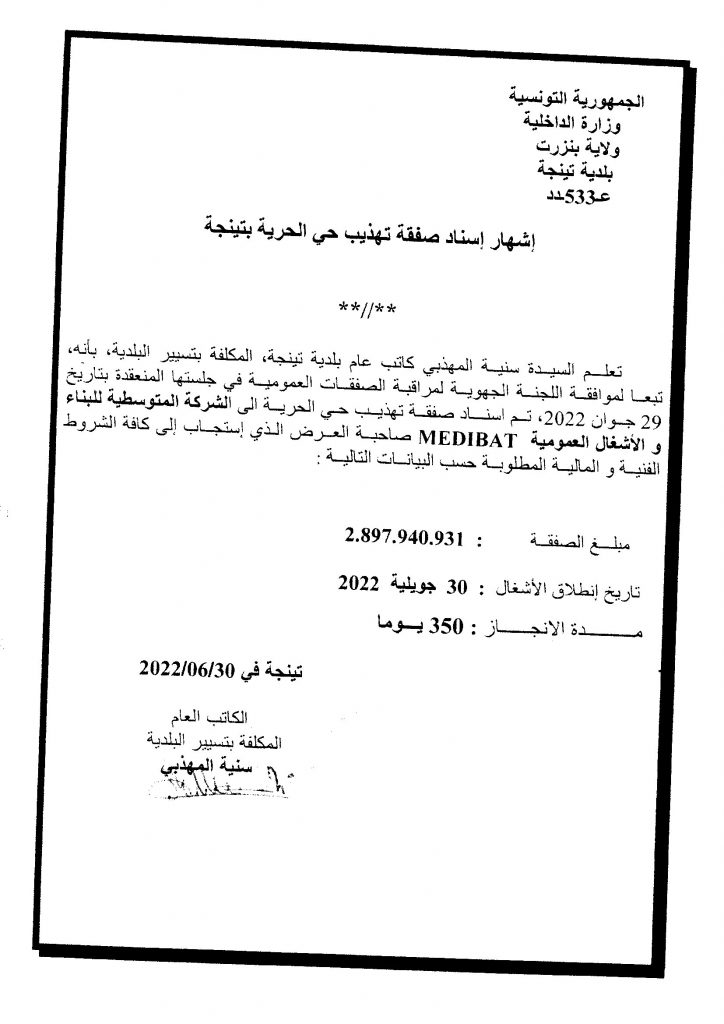

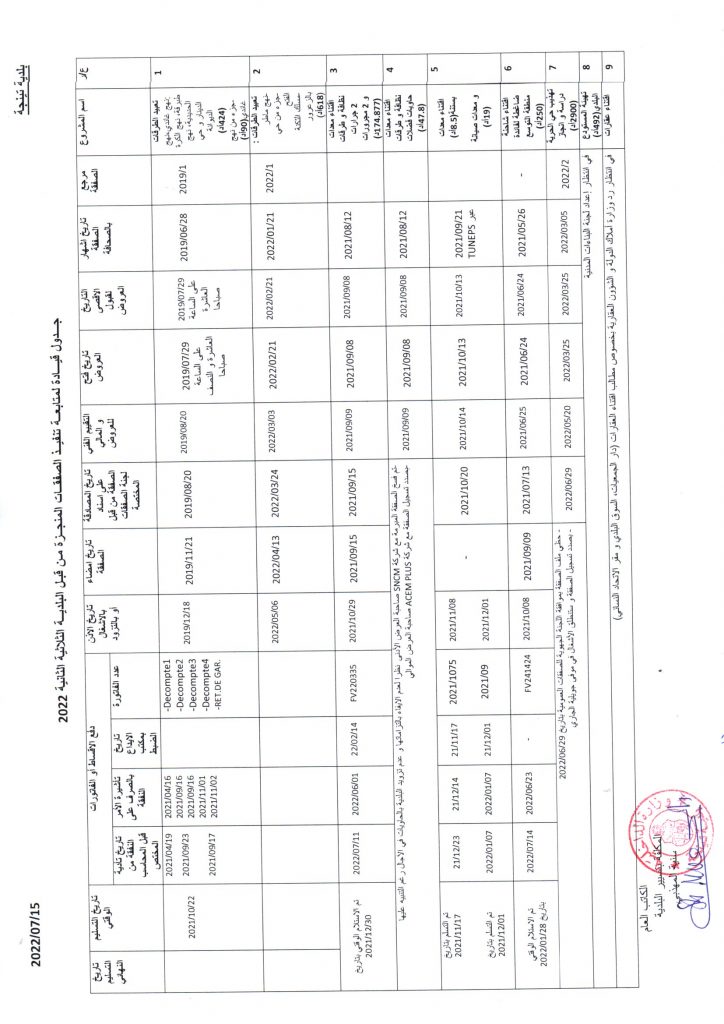

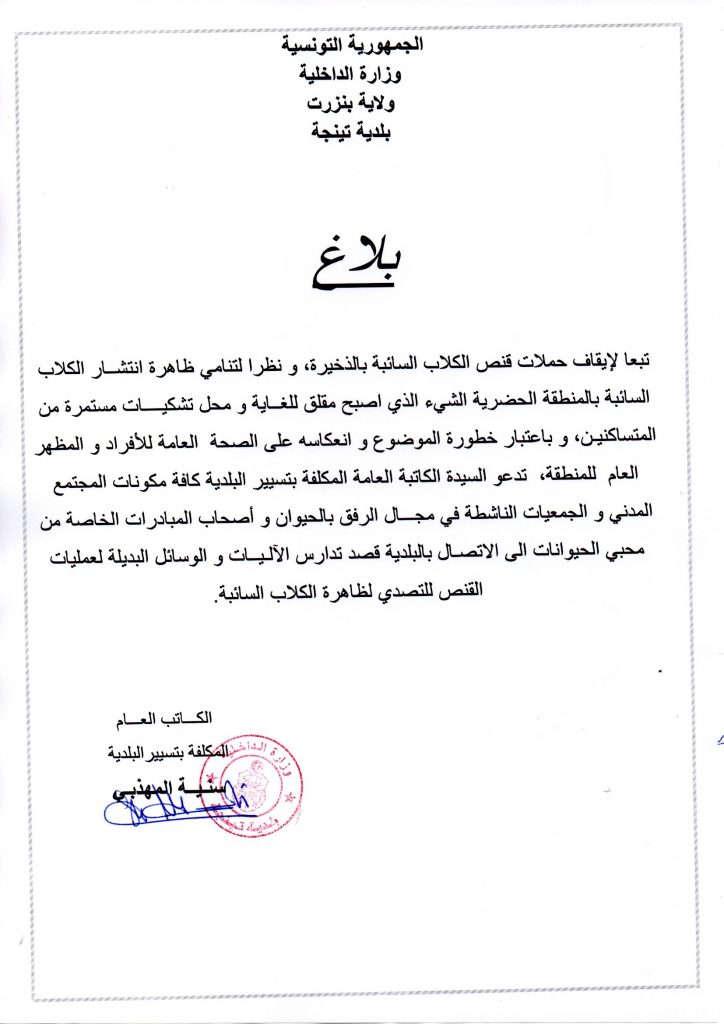

العربية

العربية