Kevin T. Litwicki | Sr. Home loan Mentor

Bust your tail therefore someone else don’t have to. That’s Jason’s purpose. Feel detailed, feel patient, and be loyal. Mix you to definitely thinking which have sense, degree, visibility, and you may advanced communication and you have a fantastic meal for success.

Jason’s mission is to make an obviously embarrassing processes as easy that one may. He isn’t happy with just taking you the best interest rate. He wants that understand the process and stay comfortable most of the step of method. Earlier subscribers explore phrases such as for example …knowledgeable, responsive, professional, readily available, beneficial… once they explain him.

Jason has been doing the loan globe just like the 2003. The guy worked for a number of different businesses ahead of beginning Stampfli Home loan from inside the 2017 in his hometown from Verona, Wisconsin. Starting your independent mortgage company is a little riskier than doing work for others. But with particular exposure appear great award. With his wife, Cindi, handling the go out-to-go out surgery, Jason normally remain worried about what he wants extremely… permitting homebuyers and you can property owners go its specifications.

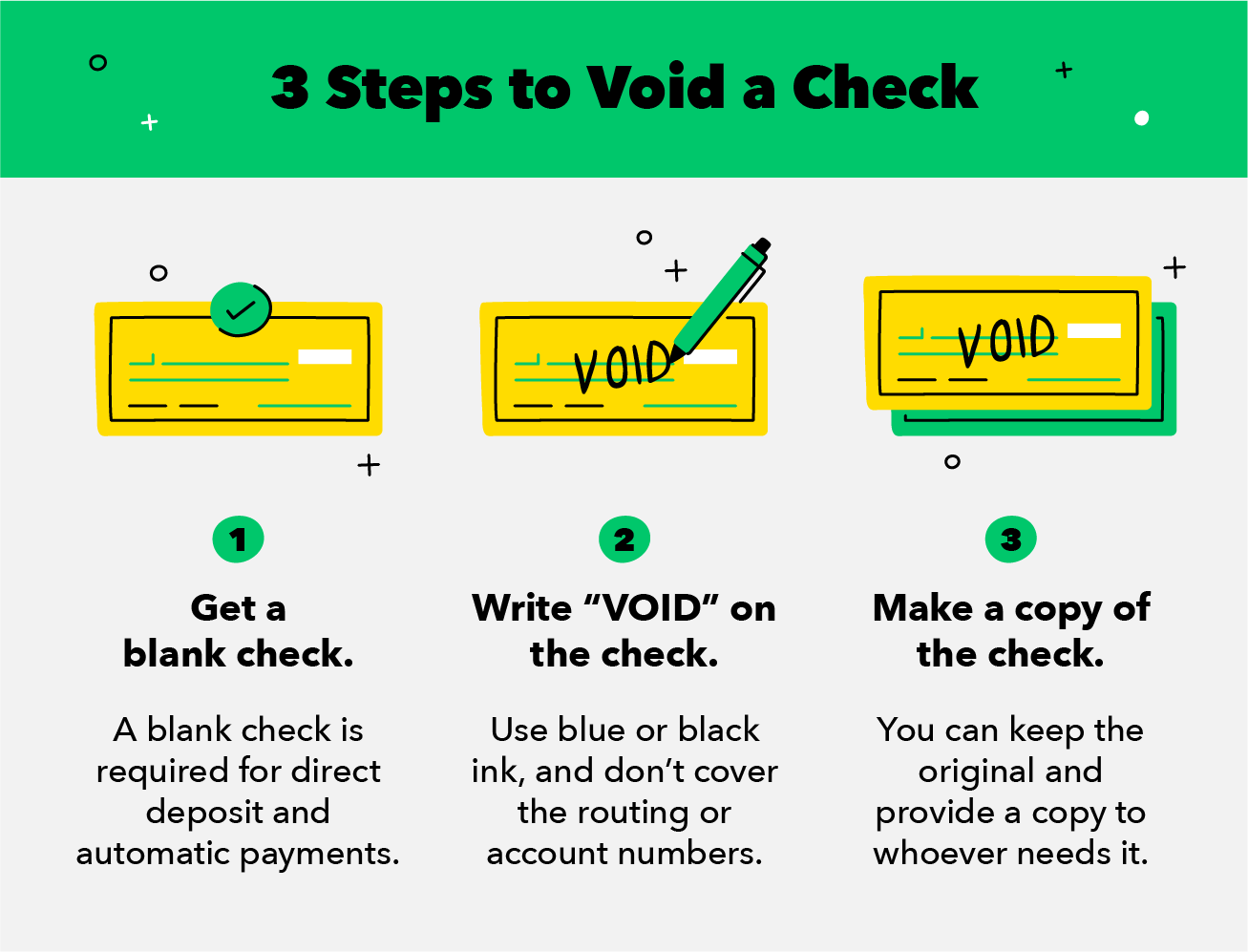

Truth be told, obtaining a mortgage was a daunting and you may intrusive procedure

You could witness Jason’s push to progress away from office because better. Even though he appreciated several football as a beneficial Verona Wildcat, Jason mainly sticks to help you tennis and you can bowling now. Most other favourite pastimes are reaching friends and family, spending some time Upwards North at relatives cabin, and you can enjoying Wisconsin activities.

A new tale of extreme occupation change. Kevin went out-of Playground Ranger to possess White Lake National Tree from inside the Colorado to becoming an elder Home loan Coach about great condition regarding Wisconsin. Stands to reason which he do come back to their domestic condition off WI, but he probably shocked a number of as he replaced inside the ranger hat for a healthy and tie.

العربية

العربية