And that lenders could offer credit line loans?

- Financial Sizes

- Personal line of credit

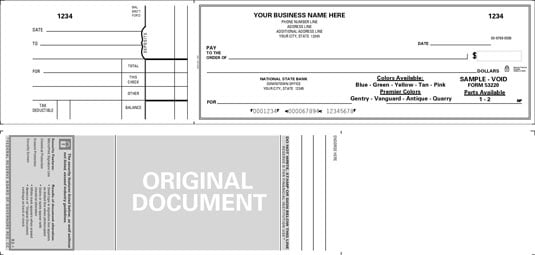

A personal line of credit (LOC) financial makes you make use of the financing since your cheque membership to help you mark off and pay-off the mortgage because you prefer.

It’s similar to a credit card because it permits your so you can withdraw funds whenever as much as a set restrict.

- CBA : Viridian Line of credit

- RAMS: Personal line of credit

- NAB :NAB Family Equity Personal line of credit

- AMP: Elite group Package Personal line of credit

The attention rates and you may costs be provided into a type of borrowing from the bank studio vary all over the loan providers but most can give comparable keeps for example Automatic teller machine access, cheque courses and you can sites banking.

If you need knowing way more, please call us to your 1300 889 743 or complete the free investigations means to talk to one of the lenders now.

Do I nonetheless you would like a bank account?

Generally, when you have a credit line (LOC) you then do not require a checking account because each one of your income and you can expenditures are explain to you your property financing.

Hence, LOCs are also known as everything in one profile or all in one lenders. There are numerous threats in using a personal line of credit in this way.

What are the advantages of a personal line of credit?

A personal line of credit offers the individuals a chance to feel a sense of versatility and you can choice through its mortgage. When you’re cautious with your money and want the flexibility a line of credit could offer, next these mortgage could well be well suited for your requirements.

- You could withdraw doing your own borrowing limit without the need to look for acceptance from your own lender.

- The credit restriction number usually are somewhat large and that mean your renders large read more instructions as opposed to going-over brand new restrict.

- The interest prices are generally lower than you to definitely given due to a mastercard, often at your home mortgage prices or just a tiny highest.

العربية

العربية