But there is one last recognition, in fact it is when the loan is largely financed (through the otherwise just after the fresh Durango loans locations closing)

The scenario significantly more than is one exemplory instance of home financing conditional recognition. In this practical analogy, the consumers must define and you may file an enormous put with the the checking account.

- Income verification: The lender may need additional records to verify your existing money. This might are pay stubs, W-2s, or tax returns.

- Work verification: They might require a letter from the manager saying your role and you will paycheck.

- Asset verification: The lending company must look for lender comments or capital account files to make certain you may have sufficient funds into the deposit and you may closing costs.

- Appraisal situations: Should your property assessment is available in below asked or brings up issues about the fresh new property’s condition, the financial institution can get impose criteria about the new appraisal.

- Credit Things: In the event that you can find discrepancies otherwise complications with your credit score, instance late costs or large personal debt accounts, the lending company might require causes otherwise a lot more documentation. You can look after this by dealing with one problems in your borrowing from the bank declaration and you will getting factors when it comes down to negative affairs.

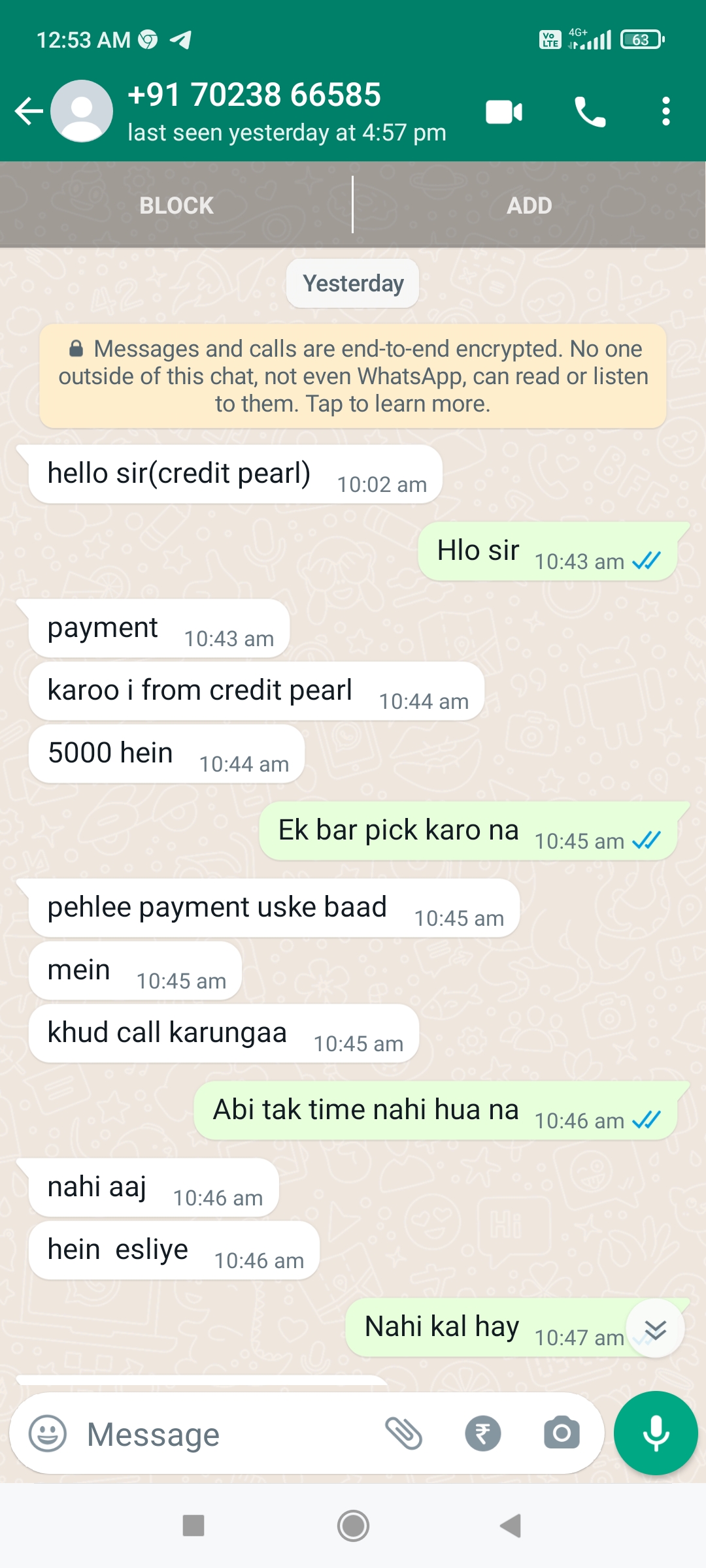

- Financial deals: Mortgage underwriters often consult additional information according to higher lender deposits or distributions. This is accomplished to confirm the main cause of money useful for your advance payment and settlement costs, and also to evaluate debt stability.

Throughout of those times, the path to solution is the same. New debtor need certainly to assemble the necessary documents, submit it with the bank, and you will target every other outstanding products so you’re able to flow new basketball pass.

Note: This can be a limited a number of common home loan criteria. Based on your role, you could stumble on a lot more underwriting needs maybe not secure above. Or you could sail from the process with no issues at all. It may vary!

Will My personal Mortgage Nonetheless Go through?

There are various grade away from approval inside home loan credit processes. It is vital to understand that things can go completely wrong at any phase from the processes, right up on the last closure.

Home buyers and you can financial consumers commonly envision he’s home free once they discovered an effective pre-recognition of a lender. But that’s not always the truth. A great pre-approval only function you will find a likelihood you are approved on financial, as underwriter gives you a good thumbs-upwards.

Becoming pre-approved possesses its own masters. It can help your thin their houses look and may even create vendors much more likely to just accept the offer. But it’s maybe not a make certain that the deal is certainly going because of.

There are many different situations and you may problems that may occur within pre-approval and you may final investment. The newest conditional home loan acceptance is one of those people price shocks.

Top behavior: Correspond with your loan manager or mortgage broker throughout the procedure. Being proactive at this time may help end undesired waits and you will keep the closure for the schedule!

The length of time can it try romantic to your a mortgage, shortly after searching an effective conditional recognition in the underwriter? Can i be able to personal on time, otherwise will it decelerate the process?

- The latest the total amount and complexity of one’s known conditions

- Committed it entails on the best way to eliminate the issue(s)

In some instances, underwriting conditions is going to be resolved inside a couple of days. Think about the page of reasons mentioned before. You could build a page to explain a financial withdrawal or deposit an equivalent big date that you receive new request. The underwriter you are going to next obvious the difficulty and move forward.

Other times, you may need to do more legwork to respond to a problem. Maybe you have to help you round up specific records otherwise build an effective couple phone calls. This may create for you personally to this new underwriting techniques, which could push the closing right back a few days.

العربية

العربية