For those who currently have both a home security mortgage otherwise a good domestic collateral personal line of credit (HELOC), it might seem regarding refinancing it to save money, expand your loan identity, or use even more. Next review discusses certain considerations to take on before you apply for an alternative financing to be sure it can see your own need and you may monetary wants.

Determining if or not you might make the most of refinancing property collateral mortgage is the first rung on the ladder on refinancing processes. According to disease, refinancing might not continually be the best option. For that reason, it is critical to very carefully check out the benefits and drawbacks before applying.

To help you Lock in a diminished Rate of interest

In the event the rates are dropping, refinancing a house equity mortgage can help you save money. With regards to the amount borrowed, a 1-dos area reduced total of the interest rate could result in high discounts.

To improve out-of a changeable-Rate to help you a fixed-Rate Mortgage

HELOCs has changeable rates, which means that the interest rate you only pay varies centered on newest markets conditions. Since the rates are rising, refinancing from a good HELOC to help you a loan with a fixed rate can protect you from future price grows.

To lower Their Payment

Refinancing a home collateral loan can help you decrease your month-to-month commission. This really is normally carried out by extending the borrowed funds term. A potential bad on the method to thought is that the prolonged you are taking to settle the loan, the greater amount of you are going to pay inside focus.

To settle Your loan Easier

Refinancing a house equity financing to a new mortgage that have a shorter identity helps you pay-off the loan more easily. This can lower your current bills so you can be eligible for another loan. It can also take back your money to store, dedicate to own old-age, or something more.

To help you Use Additional money

If you wish to use extra money, you can refinance your house equity financing towards another mortgage to have a higher matter. It simplifies your bank account so you have only you to definitely loan to help you keep up with.

To avoid Using a Balloon Commission

HELOCs usually allow you to build attention-simply money during the mark several months. In the event you it additionally the HELOC concludes, not, you’re necessary to generate a balloon commission to the a great balance.

By refinancing until the mark months closes, you could receive yet another loan having a fixed interest rate and you can cost name. This lets your pay-off the balance throughout the years as opposed to with to bring about a complete matter immediately.

Refinancing Alternatives for Household Guarantee Loans

Another step up brand new refinancing techniques is to try to decide which financing option is right for you. As the closing costs are a significant said, it is additionally vital to consider the newest interest and just how enough time just be sure to pay off your brand-new loan.

Brand new home Collateral Loan

Replacing a property equity loan that have a new home security mortgage try a common refinancing alternative. You need to use this tactic so you can acquire additional money, instance, should your collateral of your house has grown.

Cash-Out Re-finance

That have a finances-out re-finance, you will get a different financial to exchange your current home loan. Might obtain more than the brand new benefits number on https://paydayloanalabama.com/southside/ the loan, yet not. The excess cash is familiar with pay-off your current domestic security loan. It is also familiar with funds almost every other purchases. The new closing costs to have a money-aside re-finance would be like obtaining a first home loan.

Refinancing property Guarantee Loan

After you have concluded that refinancing will help you to reach finally your financial wants and you have picked a knowledgeable financing selection for your position, you will then have to apply for an alternative loan.

It is important to make certain you have a very good borrowing from the bank score before applying. If you are not sure regarding the latest score, you might obtain 100 % free duplicates of credit history out-of each of one’s around three credit rating bureaus (Experian, Equifax, TransUnion).

Make sure you remark brand new records to be sure they won’t contain any errors. In addition to your credit score, your lender may also think about your earnings, a job history, and you can most recent expense when comparing you for a financial loan.

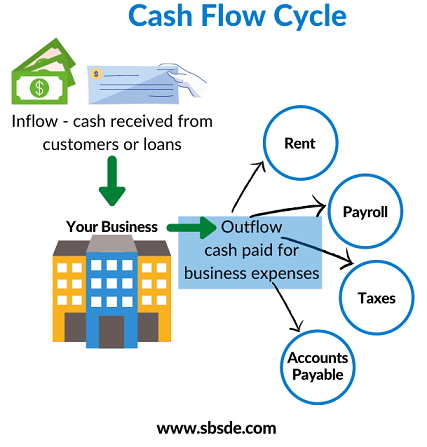

Also, it is important that you don’t possess way too much debt when you pertain. To test your existing bills, their financial uses an effective metric known as the obligations-to-income (DTI) proportion. Since the identity implies, it is a simple review of newest bills so you can exactly how much you have made monthly. You’ll determine the DTI ratio inside three simple actions:

- Make sense your own month-to-month obligations money

- Dictate the monthly earnings

- Split their month-to-month personal debt money by the monthly earnings

This new DTI ratio is often expressed since a percentage, and you will loan providers favor DTI rates from 35% otherwise quicker. If the your is large, you may be able to cure it by paying from specific of your current bills before you apply. This can change your chances of loan acceptance.

Home Security Fund With Liberty Borrowing Connection

If you are considering refinancing a current mortgage otherwise HELOC with a special domestic guarantee loan, Liberty Borrowing Relationship has the benefit of a property equity mortgage with competitive desire prices. You may be capable acquire around 110% of one’s property value your home.

And additionally, every mortgage behavior are produced in your community, you don’t have to hold off if you find yourself individuals you haven’t met or spoke in order to analysis debt advice. Click lower than to learn more about the house collateral finance.

العربية

العربية