There are lots of methods improve odds of getting a mortgage, including improve your likelihood of finding a low financial price (that’ll enables you to buy more).

See their numbers, inside and out. Are you currently paying on your own a regular salary? Do you know the overall providers expenses and financial obligation? What about the monthly organization earnings? The borrowed funds pre-recognition processes is a lot smoother if you’re able to address this type of inquiries before meeting with a coach.

Shed the deductions. When you’re thinking-operating, you will find numerous deductions you might drink purchase in order to help reduce your own tax accountability. Simply put, it hurts the debt-to-earnings ratio. By law, financial institutions have to be sure to have enough income so you can be eligible for your residence – very they will not feel very versatile to your an off the courses-variety of income plan.

A common misunderstanding we come across out-of separate designers, is the fact that the earnings they earn is the earnings we will include in qualifying them, which is often not the case,” notes Minatel.

Keep the individual and you will business membership separate. It can be enticing to utilize your company membership to spend for the personal need or charge versa when it is just you running your online business. Don’t dirty this new seas financially – it makes it more complicated into financial to determine whether or not you probably qualify for financing.

Check in and you may permit your company. Even though it is far from called for, it assists create easier for you to help you qualify. Joining a business once the a separate deal makes sense out of a great qualifying view, while the company often traditionally need to be operational for at minimum 2 yrs and you want evidence of so it,” advises Minatel.

However, the possible lack of taxable earnings for the courses causes it to be much harder to track down a home loan – it makes you look like you will be making less money than your are indeed

Alter your credit rating. That is always true getting financing – the greater the newest rating, the better your own financial rate, while the simpler its in order to be considered.

Generate a larger down payment. If you’re financially in a position to, build more substantial deposit – it will help to ensure lenders that you’re not more likely a liability, since your financing balance is gloomier.

Usually do not accept most financial obligation during this period. Loan providers was cautious with last-moment change towards financials; additionally you don’t want to risk pressing your debt-to-money ratio above the maximum.

Hire an effective CPA (Authoritative Social Accountant). You do not have for good CPA whenever being qualified for a home loan. Yet not, this may make something more standard, instance towards independent builder having an elaborate income tax state, explains Minatel.

Exactly what are the Best Mortgage brokers to possess Self employed Someone?

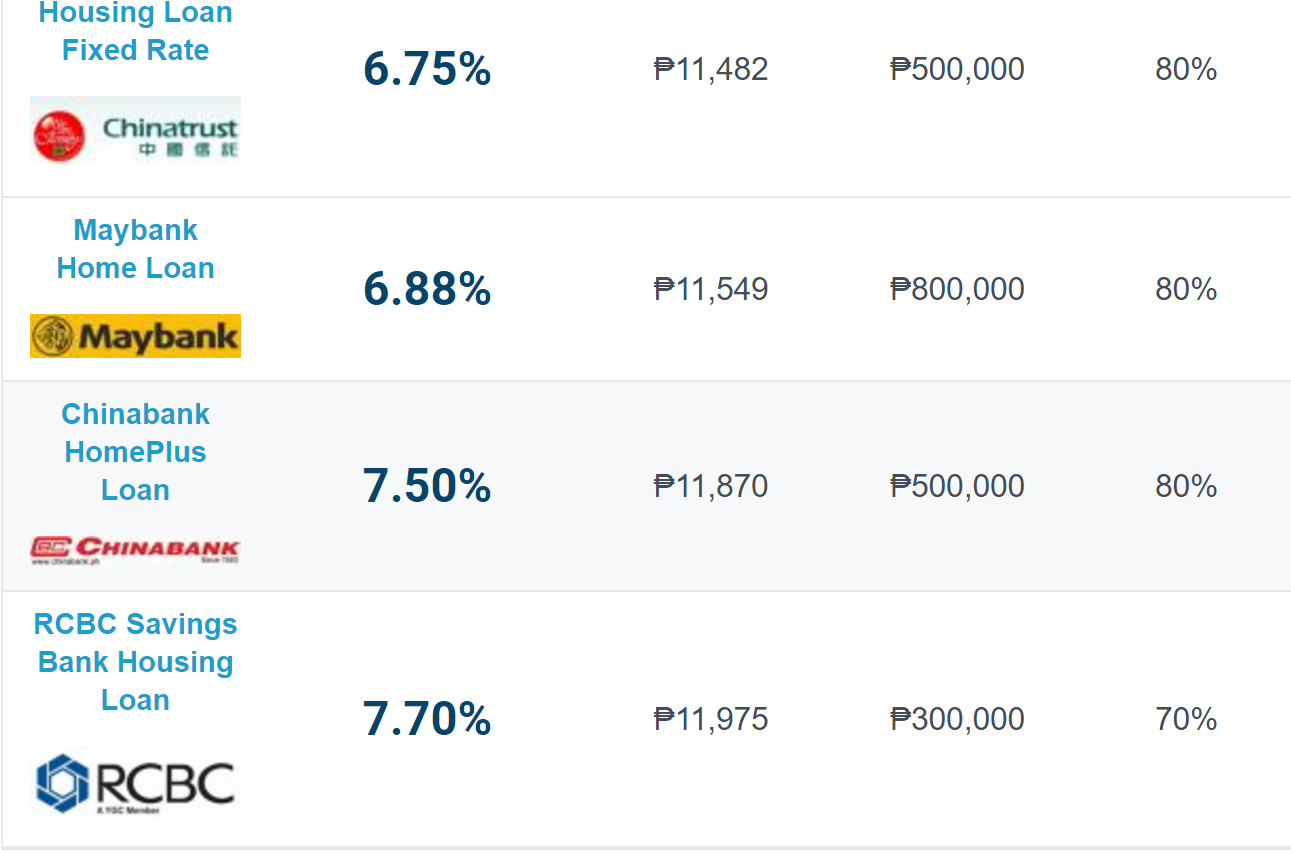

It is usually best if you comparison shop so you can numerous loan providers – and you will inadvisable to only go to your bank and you can accept whichever mortgage promote they supply. Someone can go to around three other lenders and you can started away having about three quite other also provides. However, even when someone offers a loan rate https://www.clickcashadvance.com/installment-loans-va/clover/ which is .1% better than the following bank, which can be the equivalent of several thousand dollars along the life of the loan.

“Typically, most of the loan providers are likely to accessibility the newest independent designers income brand new same manner,” says Minatel. “They should dont choose certain professions otherwise businesses (independent designers) more anybody else.”

Houwzer’s home loan group does the fresh new doing your research to help you loan providers for your requirements, saving you go out if you are getting a personalized home loan service. In the place of most mortgage officers, that happen to be repaid a percentage, Houwzer’s financial advisors is salaried – making certain their attract is on acquiring the best financing you’ll to you, as opposed to looking for you the best financing for their salary.

العربية

العربية